Introduction

Many Kenyans dream of owning land or a home but struggle to save enough money. The truth is — savings are not leftovers. You must plan them from your income before spending. With proper budgeting, even those earning below KES 100,000 can build consistent savings and invest in real estate and other profitable ventures.

1. Start with the 50/30/20 Budgeting Rule

A simple and effective budgeting formula is the 50/30/20 rule.

Here’s how to apply it:

50% for Needs: Rent, food, transport, school fees, utilities.

30% for Wants: Entertainment, dining out, shopping, or holidays.

20% for Savings & Investments: This portion builds your financial future.

✅ Example:

If you earn KES 100,000, then:

KES 50,000 → Needs

KES 30,000 → Wants

KES 20,000 → Savings & Investments

You can adjust these percentages slightly to fit your lifestyle, but the key is to save first — not after spending.

2. Automate Your Savings

Don’t rely on memory or discipline. The best trick is to automate your savings.

Open a separate savings or money market account.

Set an automatic transfer of, say, KES 10,000–20,000 immediately after your salary hits.

Avoid withdrawing this money for day-to-day expenses.

When savings are automatic, you’ll hardly notice the deduction — but your money will keep growing quietly.

3. Build an Emergency Fund

Before investing, ensure you have at least 3–6 months of your expenses saved for emergencies.

For example, if you spend KES 60,000 monthly, target KES 180,000–KES 360,000 as your emergency fund.

This protects you from unexpected costs and keeps your real estate savings safe.

4. Save Towards Real Estate Investments

Once your emergency fund is set, direct your savings toward real estate.

Here’s how to do it smartly:

Set a clear goal: Example – Buy a plot worth KES 800,000 in 2 years.

Calculate monthly savings:

[ 800,000 ÷ 24 = KES. 33,333 { per month}]Find a high-yield account or SACCO: Earn interest while saving. SACCOs also allow you to borrow up to 3 times your savings — great leverage for land or property investment.

5. Invest in Real Estate Gradually

Start small and grow:

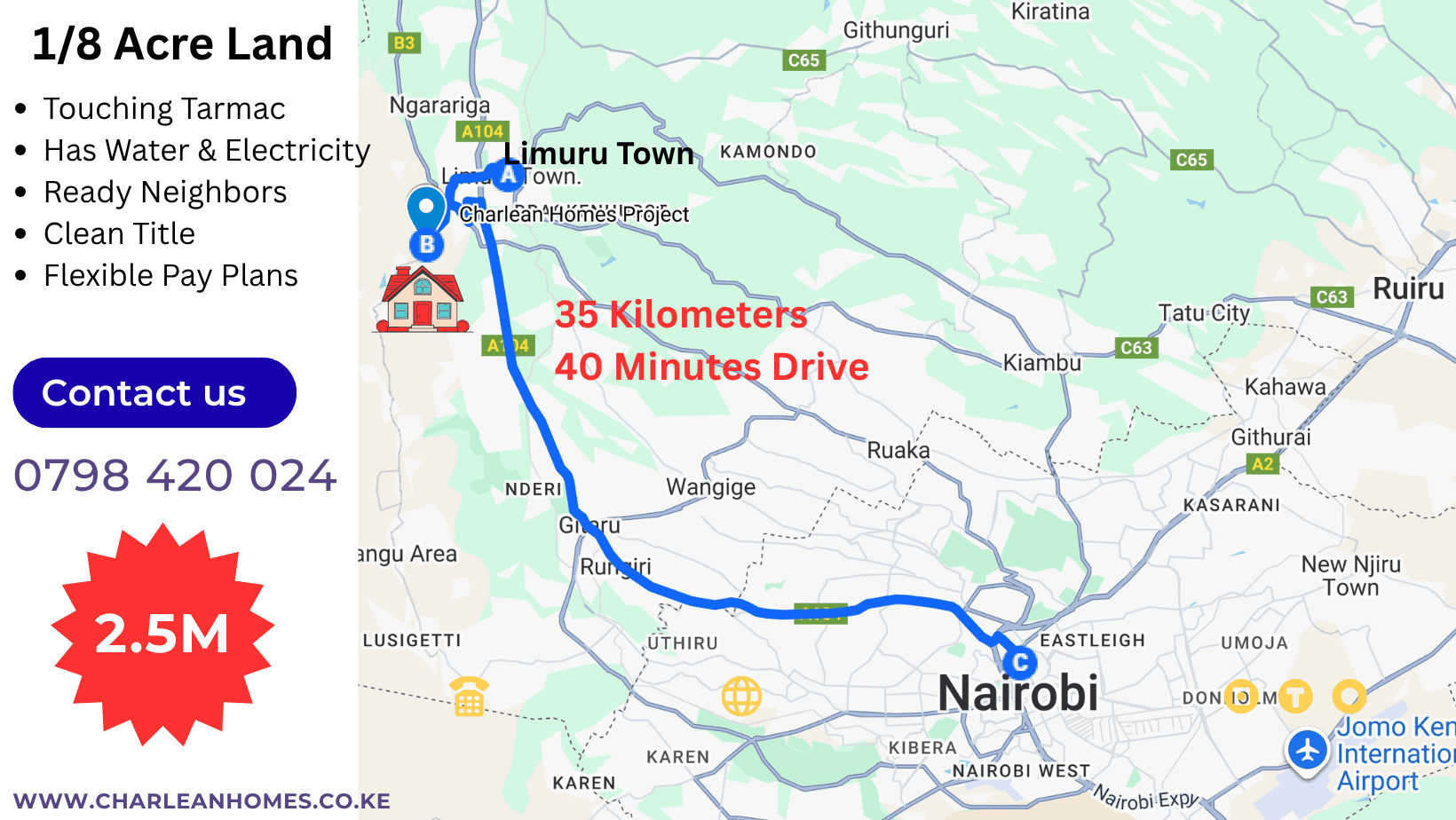

Begin with affordable plots (1/8 acre) in developing towns such as Ruiru, Juja, Limuru, Kiambu, Thika, Kitengela, Machakos or Nakuru.

Once your land appreciates, sell or use it as security for more investments.

Consider joint investments with trusted friends or family to buy bigger properties.

Real estate grows steadily, especially when located near expanding infrastructure or towns.

6. Other Investments to Grow Your Money

While saving for real estate, diversify your investments to grow your wealth faster:

Money Market Funds: Safe, flexible, and ideal for short-term savings.

Government Bonds or T-Bills: Secure and earn better returns than ordinary accounts.

Unit Trusts or Mutual Funds: Good for medium-term goals.

Stock Market: Buy shares of strong companies at the Nairobi Securities Exchange (NSE). Start small and reinvest your dividends.

These options help your money earn interest instead of sitting idle.

7. Avoid Lifestyle Inflation

As your income grows, don’t increase your spending at the same rate.

Instead, increase your savings percentage. For example, move from saving 20% to 25% or 30%. That’s how wealth builds silently over time.

Final Thoughts

Budgeting is not about denying yourself — it’s about directing your money with purpose.

Irrespective of what you earn, start today:

Save first.

Automate your savings.

Grow your money through smart investments like real estate.

With consistency, you can own land or property in Kenya sooner than you think.